Tax transparency

Taxes are an important mechanism by which Wesfarmers contributes to the communities in which we operate. Wesfarmers acknowledges taxes are a key source of revenue to stakeholders therefore it is our responsibility to have a high standard of tax governance to ensure we meet our statutory obligations. Global Reporting Standard GRI 207: Tax 2019 came into effect on 1 January 2021. We are pleased to show our continued support for corporate tax transparency by disclosing our approach to tax, tax governance framework and country-by-country reporting figures for the first time in line with this best practice reporting guidance.

Approach to tax

Wesfarmers is committed to full compliance with statutory obligations and takes a conservative approach to tax risk. Our organisation’s tax strategy is publicly available in the Tax Contribution Report that has been published annually since 2016.

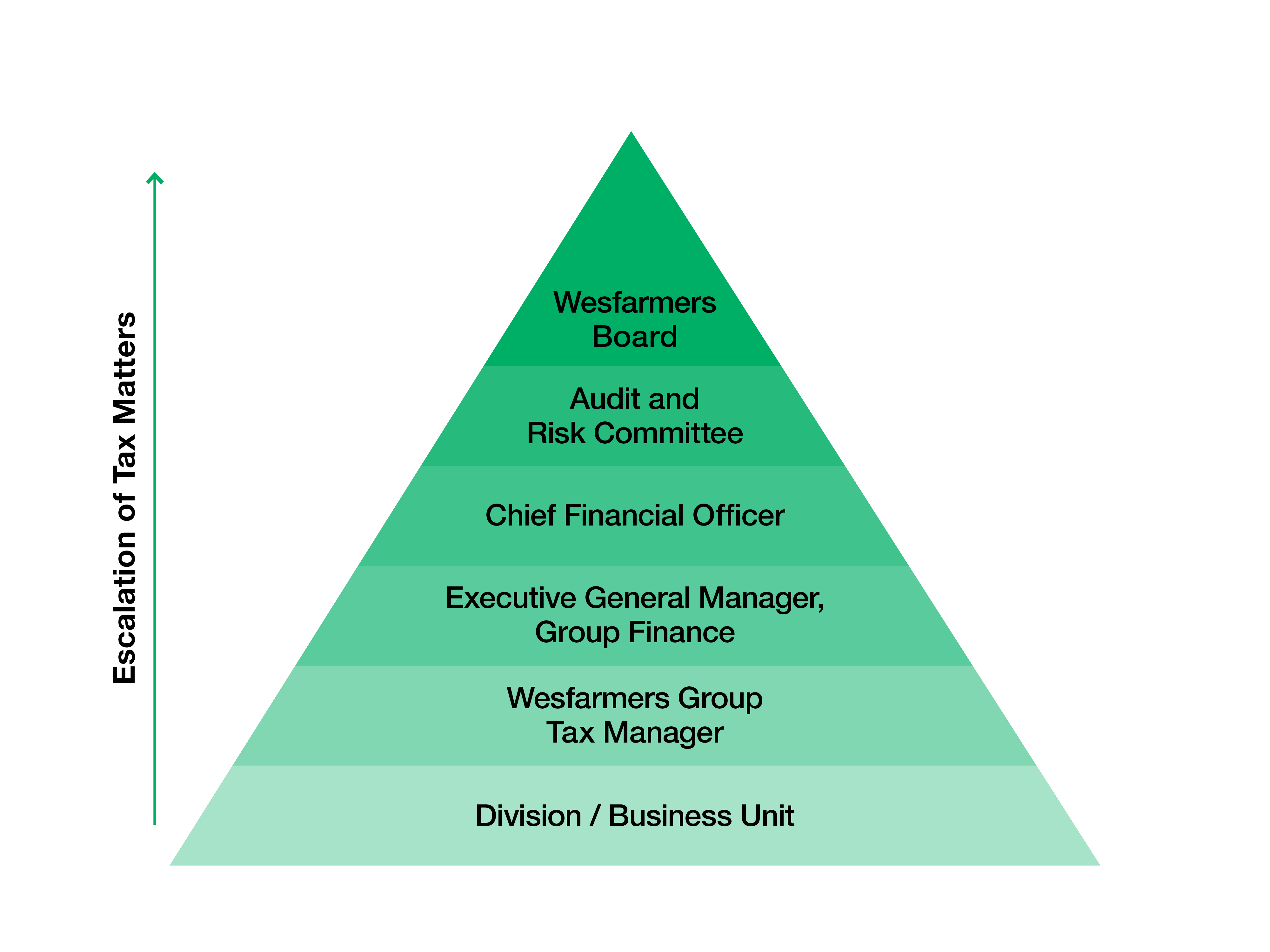

Our tax strategy is implemented through Wesfarmers’ Group Tax Policy. The Group Tax Policy is reviewed on a regular basis and was last updated and approved by the Audit and Risk Committee in March 2021. Wesfarmers’ Group Tax Policy includes an internal escalation process for referring divisional or business unit tax matters to the corporate Group Tax function. The Executive General Manager, Group Finance must report any material tax issues to the Wesfarmers Board.

Wesfarmers’ approach to regulatory compliance is to operate and pay tax in accordance with the tax law in each relevant jurisdiction. Wesfarmers seeks to have a transparent and cooperative relationship with the Australian Tax Office (ATO) and other relevant tax authorities.

Our tax strategy is aligned to our Code of Conduct, i.e. ‘The Wesfarmers Way’, and sustainable development strategies of the organisation. Our businesses’ structures are driven by commercial consideration, substance and are aligned with Wesfarmers’ conservative approach to tax risk.

Wesfarmers believes being transparent about taxes paid is a critical enabler to building trust with our communities and holds us and others to account. Contributing the appropriate amount of tax revenue in the communities in which we operate creates jobs and gives government the opportunity to provide essential services to citizens and confidence to invest in their communities to make them more sustainable over the long term.

Tax governance and control framework

The Wesfarmers Audit and Risk Committee ensures the organisation is accountable for compliance with the Group Tax Policy. The Group Tax Policy allocates responsibility for compliance with Applicable Tax Laws1 in all jurisdictions in which the Wesfarmers Group operates between the corporate office, business units and divisions. It cannot be amended without approval from the Wesfarmers Audit and Risk Committee. Any updates to the Group Tax Policy are communicated to divisional CFOs and division/business unit Tax Managers (or equivalent) by Wesfarmers’ CFO and Group Tax Manager.

Wesfarmers Group Tax Policy is underpinned by our core values framework of The Wesfarmers Way. The Core Values are Integrity, Openness, Accountability and Entrepreneurial Spirit.

Acting honestly and ethically, transparency in reporting, accountability for our reputation and adopting an ‘owner’ mindset are key features of the Wesfarmers business model and tax governance framework. Wesfarmers has clear controls and processes within our governance framework to manage tax risks and ensure we meet our regulatory obligations.

Tax risks: identification, management and monitoring

Any material or non-routine tax issues or correspondence from any tax authority in Australia or globally must be referred to Group Tax in accordance with the Group Tax Policy. Non-routine tax issues include acquisitions, divestments, major capital expenditure programs and the identification of any unlawful or unethical behaviour in relation to tax. The Executive General Manager, Group Finance must refer any material tax issues advised to Group Tax to the Chief Financial Officer, the Audit and Risk Committee and Wesfarmers Board as soon as practicable. Compliance with the Group Tax Policy is monitored by the Wesfarmers Audit and Risk Committee.

Maintaining appropriate levels of skilled staff within the divisions/business units ensures compliance with Applicable Tax Laws. Where an uncertain tax issue arises, the Group aims for certainty on all tax positions it adopts. Where the tax law is unclear or subject to interpretation, advice is obtained and when necessary the ATO (or other relevant tax authority) is consulted for clarity. All roles and responsibilities of external tax advisors must be documented and approved by the Wesfarmers Group Tax Manager on an annual basis.

Group Tax supports the divisions/business units by providing internal or external advice on the interpretation and implementation of Applicable Tax Laws, as necessary. Any material tax issues escalated to the Wesfarmers Board are documented in a monthly Board Report. Group Tax updates the Audit and Risk Committee and Board on Wesfarmers’ tax compliance program in Australia and overseas, including country-by-country related party dealings. Detailed reports are provided.

Stakeholder engagement

Wesfarmers considers tax to be a material topic that should be disclosed to the communities in which we operate, tax authorities and as a matter of public policy.

Wesfarmers became a signatory to the Australian Board of Taxation’s voluntary code in August 2016 and published our inaugural Tax Contribution Report for the 2016 year in December 2016. Wesfarmers’ tax strategy is publicly available in the Tax Contribution Report that has been published annually since the initial publication. We are proud to publish our country-by-country reporting information for the first time in accordance with GRI 207: Tax for the 2020 year (2021 data to be published during 2022).

Wesfarmers’ approach to engagement with tax authorities is to seek to have a transparent and cooperative relationship with the ATO and other tax authorities. The ATO conducts an annual review of Wesfarmers’ Australian consolidated income tax returns in accordance with the Pre-lodgement Compliance Review (PCR) regime that applies to significant taxpayers, including Wesfarmers. The PCR arrangement formalises the requirement for Wesfarmers to disclose to the ATO all material transactions undertaken. Wesfarmers is also included in the ATO’s Justified Trust review of the top 100 taxpayers in Australia.

Wesfarmers captures the views and concerns of stakeholders through a variety of mechanisms, including investor roadshows, analyst calls and engagement with NGOs and key government agencies.

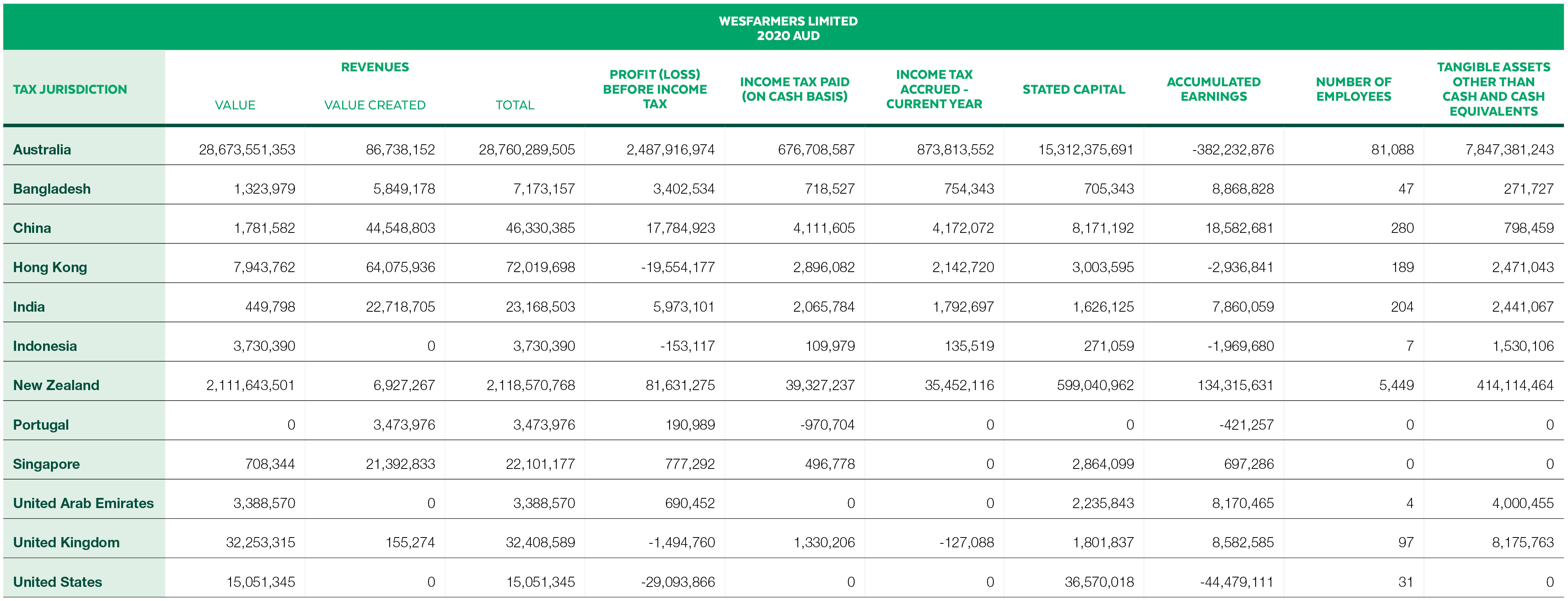

County-by-country reporting for the 2020 financial year

Country-by-country reporting is the reporting of financial, economic and tax-related information on a jurisdictional basis. Wesfarmers’ country-by-country reporting for the 2020 financial year is reproduced below. The 2021 information will be published in the second half of 2022 following lodgement with the relevant tax authorities.

Wesfarmers Limited (AUD)

To see a list of the resident entities and their primary activities in each tax jurisdiction, please click here.

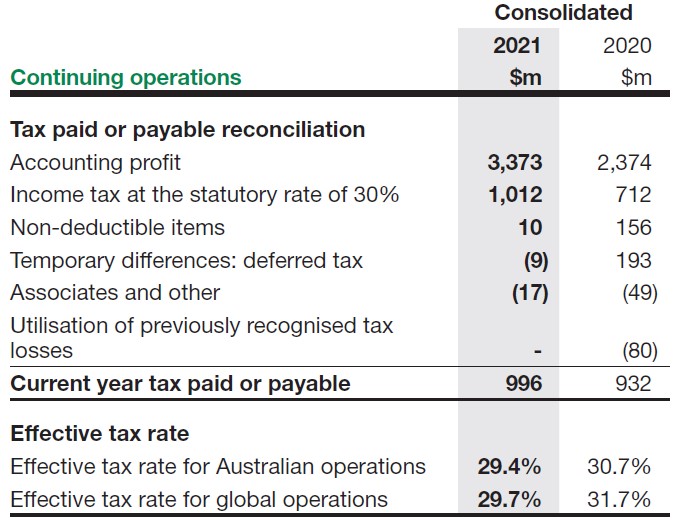

Reconciliation of differences between corporate income tax accrued on profit/loss and tax due

A reconciliation of accounting profit to income tax paid or payable and the effective company tax rates for Australian and global operations of the Group are tabled below for the 2021 and 2020 financial years.

Note 33 from the 2021 Wesfarmers Annual Report

1 Applicable Tax Laws means income tax; good and services tax; value added tax; payroll tax; superannuation guarantee tax; social security tax; fringe benefits tax; wine equalisation tax; customs duty, excise and fuel taxes; withholding tax; and any other tax law applicable to the operations of the division/business unit, in any location globally in which the division/business unit operates.

The tax disclosures included within this website were prepared internally and were materially based on the financials included in the Wesfarmers 2021 Annual Report. Ernst & Young audited the 2021 Financial Report included within the Wesfarmers 2021 Annual Report. Ernst & Young has not separately audited the detailed financials included on this website in response to GRI 207.

GRI 103-1, GRI 103-2, GRI 103-3, GRI 207-1, GRI 207-2, GRI 207-3 , GRI 207-4